Reading Notes of Peter Thiel's Zero to One

My mentor recommended that I read Peter Thiel’s Zero to One, truly a must-read for entrepreneurs. Peter Thiel is a Silicon Valley angel, a thinker in the investment world, and a founder of the PayPal Mafia.

Therefore, the author of “The Black Swan” commented on this book, saying that when a person with an adventurous spirit writes a book, it is a must-read. If the author is Peter Thiel, read it twice. But just to be safe, please read it three times, because “Zero to One” is definitely a classic.

The biggest takeaway from this book is that entrepreneurship and research are almost the same in many aspects.

All Profitable Companies Are Monopolies

The most interesting point in the book is that all successful businesses are different, or to say, all profitable companies are monopolies.

The monopolies discussed in the book are not those that rely on government resources to achieve monopoly, but those that innovate, making the products they supply to consumers unavailable from other businesses.

If there are multiple completely competitive companies in an industry, no matter how much value is created, the company’s profits will not be too much. For example, the American airline industry creates hundreds of billions of dollars in value every year, but airlines can only earn 37 cents from each passenger per flight. Google creates less value annually than the airline industry, but its profit margin is 21%, more than 100 times that of the airline industry.

Monopolists lie for self-protection, by positioning themselves as part of a larger market to fabricate non-existent competition. For example, Google does not position itself as a search engine company, but as an advertising company or a diversified technology company, the latter two markets being larger, with Google being just a minor player in the entire market.

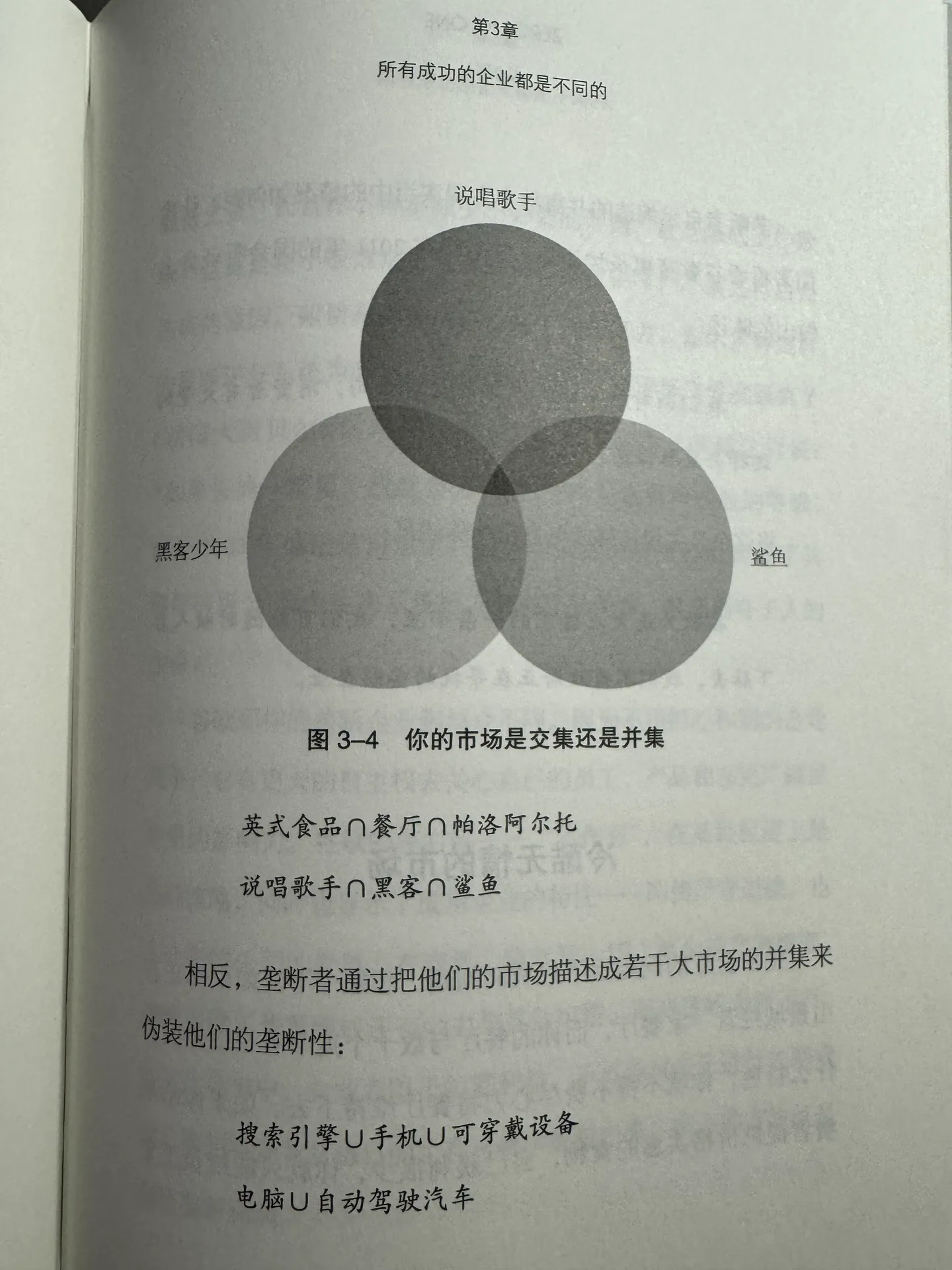

And non-monopolists, in order to exaggerate their uniqueness, often define their market as the intersection of various smaller markets. For example, an English restaurant in Palo Alto, or the only company developing an email payment system (PayPal).

But describing the market too narrowly is a deadly temptation, it seems like you can naturally dominate it, but such a market may not exist at all, or it’s too small to support a company.

All Profitable Companies Are Monopolies

All Profitable Companies Are Monopolies

This is very similar to doing research, where you must “monopolize” a small problem, that is, to solve problems that others cannot solve.

The usual way to define research problems is the intersection of several research fields. For example, my doctoral thesis “High-Performance Data Center Systems Based on Programmable Network Cards” is the intersection of “programmable network cards” “high performance” “data center systems”. Each of these fields is too large on its own, but the intersection of these three fields is a problem that I, as a PhD, can solve, and indeed, this intersection has practical value, as today’s leading public cloud providers all use technology from this intersection.

However, when choosing these fields, just like in entrepreneurship, it is also necessary to pay attention to whether the intersection of these fields really has value. For example, if I write a paper on “Large Model Training Systems Based on Microcontrollers”, it is also the intersection of three very large research fields “microcontrollers” “large models” “training systems”, but this research problem currently seems to have little value, because the computing power of microcontrollers is too poor, making them extremely slow for large model training. Unfortunately, many doctoral theses are solving such seemingly innovative but actually useless problems.

Even if the intersection of these fields has value, this intersection cannot be too small, just as a too small market cannot support a company, a too small research problem cannot support a doctoral thesis. For example, my doctoral thesis could also be written as “Low Latency Data Center Networks Based on FPGA Network Cards”, where “FPGA Network Cards” is a subset of “programmable network cards”, “Low Latency” is a subset of “high performance”, and “Data Center Networks” is a subset of “data center systems”, the intersection of these three fields is also enough to support a doctoral thesis, but the scope is much narrower than “High-Performance Data Center Systems Based on Programmable Network Cards”.

Four Characteristics of Monopoly Enterprises

- Proprietary Technology

- Network Effects

- Economies of Scale

- Brand Strength

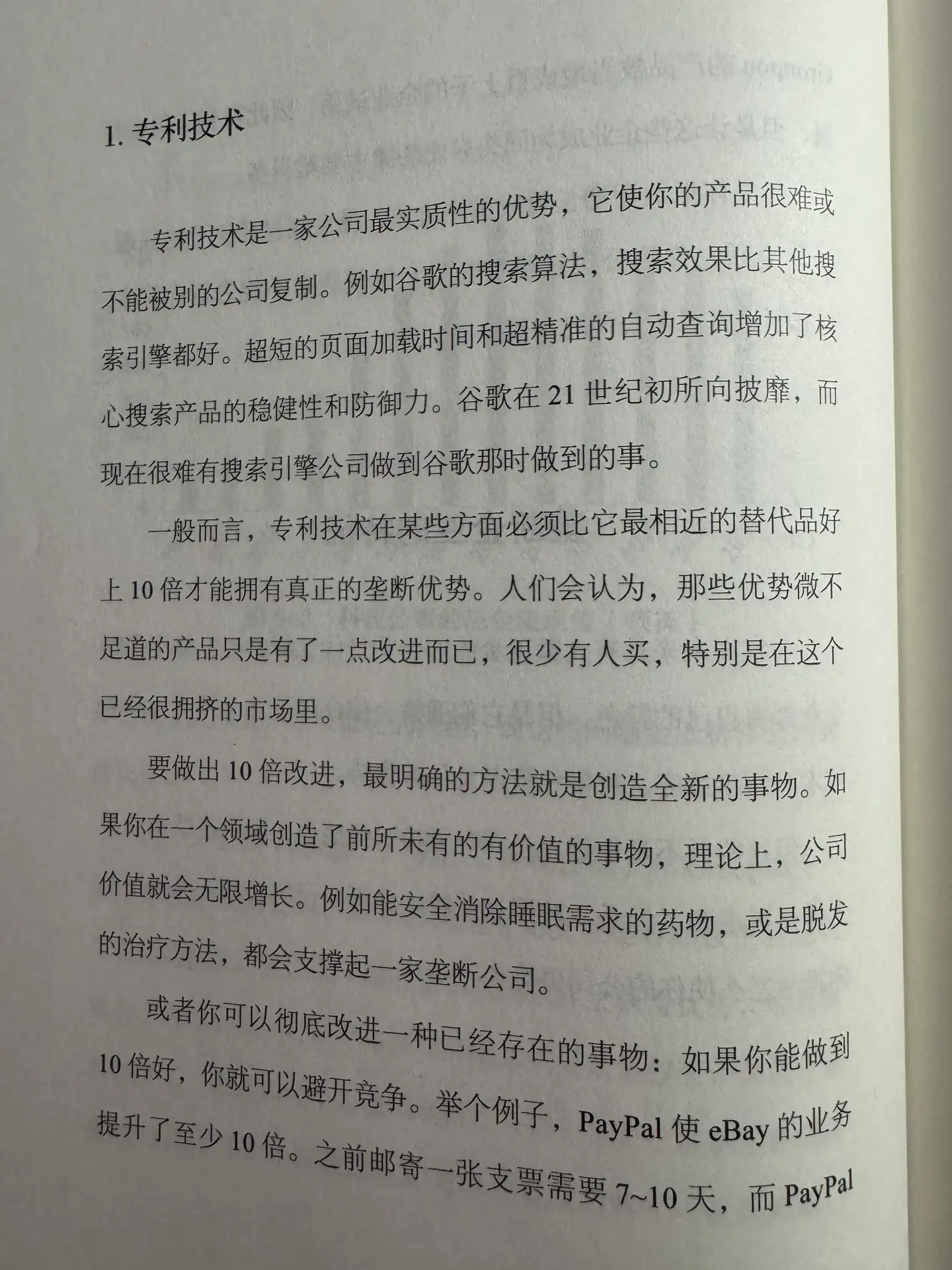

Peter Thiel believes that proprietary technology is the most substantial advantage of a company. Proprietary technology must be 10 times better than its substitutes to have a real monopoly advantage. Just making a slight improvement is not enough to support a company.

This is the same with research, my mentor constantly emphasizes to me that a good system research needs to improve performance by 10 times to be published in top conferences. Microsoft Research Asia’s report on our work was titled “Tinkering with Systems, Making Their Performance Increase by 10 Times“.

A good enterprise must make a 10-fold improvement

A good enterprise must make a 10-fold improvement

Entrepreneurship Requires Contrarian Secrets

The book starts with a question: What important truth do very few people agree with you on?

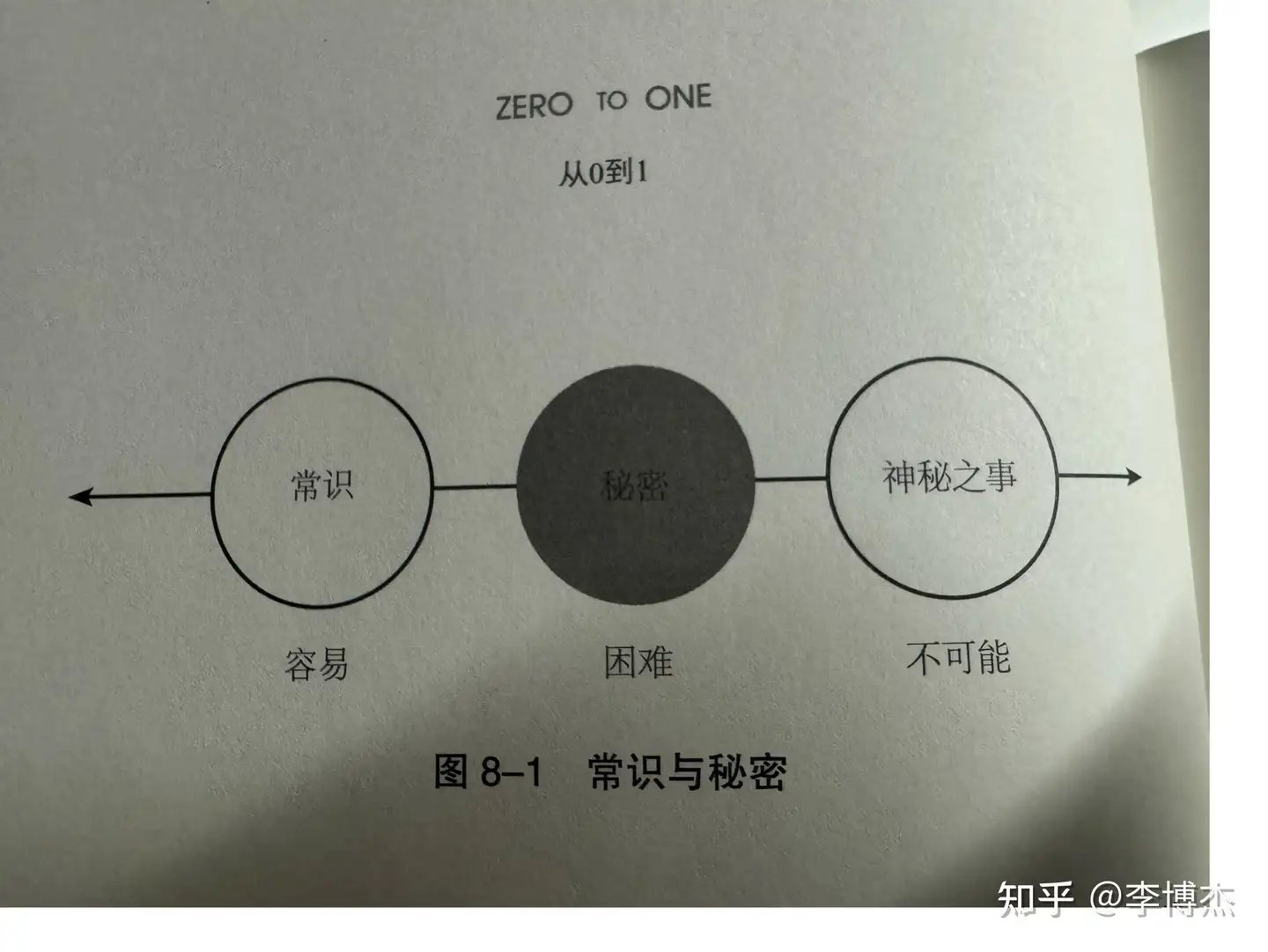

Every correct answer is a secret, some things are very important yet unknown, some things are difficult yet achievable. Entrepreneurship is about finding a unique opportunity that others have not discovered.

When you discover a secret, you face a choice: tell others, or keep it to yourself?

Some secrets are more dangerous than others. There is a golden balance between choosing to tell no one and choosing to tell everyone, and that is the secret existence of companies. All successful businesses are founded on little-known secrets.

When Peter Thiel founded PayPal in 1998, the company’s vision was to create a virtual currency to replace the dollar. Note, this was in 1998, and Bitcoin was not invented until 2009. In 1998, “creating a virtual currency to replace the dollar” was a contrarian secret, saying it out loud could even be dangerous, but it was such secrets that made PayPal different.

Of course, the company’s vision is different from the product form. This is also where many entrepreneurs get confused. PayPal’s first product allowed people to transfer money using PDAs, but no one needed this product because PDAs were not widely used at that time. PayPal’s second product was an email payment system, which eventually gained more and more users. PayPal was acquired by eBay four years after its establishment, without the opportunity to realize the grand vision of “creating a virtual currency to replace the dollar”, but the founding team of PayPal, like the “Traitorous Eight”, spread the seeds of entrepreneurship throughout Silicon Valley.

Commonly known truths are common sense, little-known truths are secrets, and mysteries are things no one knows the answer to

Commonly known truths are common sense, little-known truths are secrets, and mysteries are things no one knows the answer to

The golden balance between choosing to tell no one and choosing to tell everyone is the secret existence of companies

The golden balance between choosing to tell no one and choosing to tell everyone is the secret existence of companies

Company vision is not equal to product form

Company vision is not equal to product form

Research is the same, good research is because of discovering contrarian secrets. The most valuable topics and directions in a field are often the consensus within a small circle, that is, “public secrets”.

If You Don’t Have a Brilliant Idea, Don’t Start a Business

Some people ask, if I can’t find a sufficiently valuable monopoly field, don’t have a 10-fold competitive patent technology, and don’t hold any contrarian truths, then how can I start a business?

Peter Thiel’s answer is, then join a rapidly growing first-class company, don’t start your own business.

Outstanding talents are more hesitant than others when choosing to start a business, they know the power of the power law (Pareto principle), joining a rapidly growing first-class company will achieve greater success. The power law means that the differences between companies will make the differences in roles within the company seem insignificant.

Joining a rapidly growing first-class company will achieve greater success

Joining a rapidly growing first-class company will achieve greater success

Research is the same, if you are not capable of conducting independent research, joining a rapidly growing first-class research team is more likely to succeed.

Startup Recruitment: Attract Unique People with Vision

Peter Thiel points out that the most common mistake startups make in recruitment is being similar to other companies, for example, the following common recruitment reasons are all too common:

- You can get generous cash incentives here

- The options you get here are more valuable

- Work with the smartest people in the world

- Help solve the world’s most challenging problems

- Good company benefits, flexible working hours and locations, free food, free laundry

Every company needs a tailor-made recruitment reason, it needs to be about the company’s mission or team. If you can explain why you are doing important things that others have never thought of doing, then you can attract the employees you need. Startups should not wage a war of benefits.

For example, Peter Thiel said, at PayPal, if you are excited about the idea of creating a virtual currency to replace the dollar, then we are willing to talk to you; otherwise, you are not suitable here.

PayPal attracted a group of unique and outstanding talents with this vision, who were later known as the “PayPal Mafia”, including Elon Musk (founder of SpaceX and Tesla), Reid Hoffman (founder of LinkedIn), Steve Chen (founder of YouTube), Jeremy Stoppelman and Russel Simmons (founders of Yelp), David Sacks (founder of Yammer), etc.

The “PayPal Mafia” was not built using the traditional method of screening resumes. The method of screening resumes may find individuals who are all excellent, but their relationships with each other are exceptionally weak. They spend all day together, but rarely interact outside the office. From the beginning, Peter Thiel made PayPal employees closely united, rather than staying together out of transactional relationships.

Peter Thiel believes that in startups, “you’re either on the bus or off the bus,” and hiring external consultants and part-time employees is not feasible. People without equity only look at short-term interests, which fundamentally leads to divergence.

The key to recruiting for startups is a shared vision

The key to recruiting for startups is a shared vision

The key to recruiting for startups is a shared vision

The key to recruiting for startups is a shared vision

Many people like to attribute research failures to insufficient funding or low wages, but just like startups, good research teams are not maintained by salaries, but by a shared vision and good personal relationships.

Choosing a co-founder is like getting married

Peter Thiel believes that a company is like a country, if a wrong decision is made at the beginning, such as choosing the wrong partner or picking the wrong employees, it will be difficult to correct later.

Choosing a co-founder is like getting married, and co-founders having conflicts is like getting divorced. Every relationship starts optimistically, but the problems that may arise after some calm thinking are not so pleasant, so people don’t think about them.

It’s important for the founding team’s technical abilities and talents to complement each other, but the level of understanding and the degree of tacit cooperation between the founders are equally important. Therefore, co-founders should have a deep friendship before starting a business together, not just hit it off in a chance meeting.

To find the reasons for internal discord within the company, it is useful to distinguish between the following three concepts:

- Ownership: Who legally owns the company’s assets (founders, employees, investors);

- Operation: Who actually manages the company’s daily affairs (founders, employees);

- Control: Who formally manages the company’s affairs (board of directors).

The contradictions in startups mostly occur between ownership and control, that is, between founders and investors. The board of directors wants the company to go public as soon as possible to profit, while founders would rather keep it private to expand the business.

The size of the board of directors should not be too large. A three-person board of directors is ideal, and a non-public company’s board should not exceed 5 people. If you want to escape the control of the board, expand its size as much as possible. If you want it to operate efficiently, then reduce its size.

Founders’ cash incentives should not be too much. The annual salary of a CEO of a startup with capital injection should not exceed $150,000 (as of 2015). If a CEO’s annual salary is $300,000 (as of 2015), then he has become a politician rather than a founder.

Choosing a co-founder is like getting married

Choosing a co-founder is like getting married

Founders' cash compensation should not be too high

Founders' cash compensation should not be too high

Success is not winning the lottery

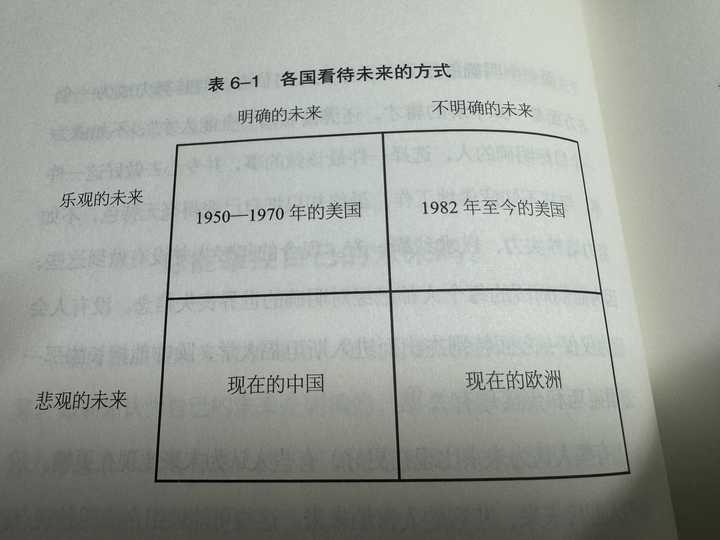

Some people think the future will be better than the present, some think the future will be worse. Optimistic people welcome the future, pessimistic people fear the future. These possibilities form four perspectives.

- Optimists with a clear view of the future can create the future they want.

- Pessimists with a clear view of the future can replicate what already exists.

- Pessimists with an unclear view of the future will fulfill themselves, if you are a lazy person with low demands on life, it’s easy to achieve.

- Optimists with an unclear view of the future are like life, life will “evolve” even without preparation. The popular term in Silicon Valley is to build “lean startups” that can adapt to changing environments, evolve with the environment, create the most basic viable product (MVP), and then repeatedly revise.

But Peter Thiel believes that lean is a method, not a goal. Long-term planning is most important, planning takes precedence over opportunity. Only with precise planning for the future can the world be changed, rather than listening to focus groups’ opinions or copying others’ success. In a world where everyone is confused about the future, companies with clear goals are always undervalued.

Expectations for the future: Optimistic/Pessimistic, Clear/Unclear

Expectations for the future: Optimistic/Pessimistic, Clear/Unclear

Success is not winning the lottery

Success is not winning the lottery

“Zero to One” contains many interesting viewpoints, and I have only picked a few that made the deepest impression. This book is well-written, and I recommend it to friends who are starting or planning to start a business.